Series Introduction

Escape Velocity is a three-part series on how civilizations become trapped, blinded to their entrapment, and how they can break free.

We’re living through a convergence of crises that conventional analysis treats as separate: unsustainable debt, elite overconsumption, social disintegration, and institutional failure. These aren’t distinct problems. They’re different faces of the same civilizational trap: a system increasingly built on simulation rather than substance.

Part I (this essay) diagnoses how we got stuck, running ever faster to maintain position in a world that increasingly doesn’t make sense to people.

Part II explores how performance replaced governance, creating a simulated world where managing perceptions matters more than solving problems.

Part III examines the strange new forces, including technologies and socio-cultural wildcards, that might jolt us off our current trajectory and give us just enough thrust to break free.

The universe is unforgiving. Systems in orbital decay either achieve escape velocity or spiral inward. There is no stable middle ground. The question isn’t whether our current trajectory is sustainable (spoiler: in Part I, I will show that it isn’t). The question is whether we can build enough momentum to break free from the gravity of decaying systems before they pull us under.

Breakthrough is still possible—but only if we confront what’s actually holding us back. Part III explores what that might require.

Subscribe here to receive updates on future publications.

Money as Signal

"We're running out of people to buy U.S. government debt."

When Jamie Dimon, CEO of JPMorgan Chase, uttered these words recently, he wasn't warning about an imminent default. He was signaling something more profound: the erosion of faith itself, not just faith in America's ability to repay its debts but faith that those debts will retain any meaningful value when repaid.

This is what civilizational turning points look like: not dramatic collapses, but moments when the stories we tell ourselves stop working. René Girard called this the collapse of mimetic containment, where social mechanisms that channel rivalry productively begin to fail. For decades, our institutions sublimated competition through upward mobility and symbolic achievements. Now these buffers are fracturing.

We're living through the convergence of three long cycles, each reinforcing the others in a spiral our current leadership class cannot, or will not, address.

A debt supercycle reaching its mathematical limits (Ray Dalio's framework)

Elite overproduction paralyzing our institutions (Peter Turchin's theory of too many elites competing for limited positions)

A mimetic crisis where institutions have lost touch with reality itself (Girard's concept of contagious rivalry destroying social cohesion)

These aren't separate problems. They're three faces of what Venkatesh Rao calls a collapse of temporal coherence: the unraveling of meaning structures that once allowed societies to sequence change, metabolize contradiction, and maintain forward motion.

For Girard, mimetic containment was civilization's outstanding achievement: channeling inevitable human rivalry into productive competition through institutions, rituals, and shared narratives. When this containment fails, societies must choose between violent breakdown or breakthrough to new forms of organization.

We're at that inflection point now.

The clearest indicator of this inflection is our ballooning sovereign debt—and the illusions still propping it up.

The $35 Trillion Question

Suggested: In 1980, U.S. debt-to-GDP stood at 35%. Today, it exceeds 120%. Interest payments now surpass defense spending and will consume most discretionary spending within a decade. Everyone knows this isn't sustainable. Yet nothing changes.

Ray Dalio's framework explains why. Nations follow predictable debt patterns:

Early Phase: Debt finances productive investments, such as infrastructure, education, and innovation. Future growth easily covers repayment.

Middle Phase: Debt increasingly funds speculation, asset prices inflate, and inequality widens. But growth continues, masking structural problems.

Late Phase: Debt merely sustains consumption. It preserves yesterday's promises rather than building tomorrow's capacity. Productivity stagnates while obligations compound.

Resolution Phase: Only painful options remain:

Austerity (politically tough, if not impossible, in a democracy)

Default (destroys the global financial system)

Money printing (the path we're on: slowly destroying savings)

Wealth transfers (requires elites to tax themselves; currently, they continue to move in the opposite direction, accelerating the sense of crisis)

Contrary to popular myths, about two-thirds of U.S. sovereign debt is held domestically by pension funds, banks, insurers, and wealthy individuals. These aren't foreign countries holding our IOUs; they're a closed loop of internalized promises across generations and classes. The debt has become the very mechanism through which wealth transfers from future producers to current owners.

The debt supercycle has reached its endgame: mathematically unsustainable, politically unresolvable, and economically extractive. We're financing today's consumption with tomorrow's production, but tomorrow is arriving faster than expected.

The Versailles Effect

Let Them Eat Clicks

The debt crisis isn't just about numbers but how elites use debt to mask their extraction from a productive society. Peter Turchin identifies "elite overproduction" as a civilizational danger, but the raw numbers only tell part of the story. Yes, we're producing more elites: MBAs have tripled since 1970, PhD holders doubled, while elite positions barely expanded. But René Girard reveals the deeper dynamic: it's not just how many elites exist, but how they compete.

Girard called it mimetic rivalry: humans don't desire independently but through imitation. We want what others want, especially those we consider peers. Among elites, this creates an arms race of status signaling that would make Versailles blush.

A hedge fund manager doesn’t buy a $50M penthouse because they need the space. They buy it because their rival purchased a $40M one. Institutions follow suit: expanding administrative bloat not to improve function, but to outcompete peers in the status economy. That’s why Bezos’ yacht has another supply yacht that follows it around.

This mimetic competition drives what we might call "net elite extraction": the total resources elites collectively take from the rest of society. It's not just that we have more elites; their rivalry creates exponentially growing appetites for positional goods: credentials, titles, real estate, influence, and other status symbols.

All this extraction hides behind debt. Rather than directly taxing the productive classes into revolt, elites engineered a system that shifts the burden to the future.

It’s a heist so slow and subtle the bank manager won’t notice the missing funds for 50 years or more.

But precision matters. The true financial elite hide in the statistical blur of 'the top few percent,' obscuring how stratified that top really is. The top 0.1% looks nothing like the top 1%, and conflating the two only serves to obfuscate. Scott Galloway notes that the crucial distinction is between super earners and super owners. Super earners are high-income professionals whose wealth comes from labor and innovation. Super owners live off accumulated capital and inheritance.

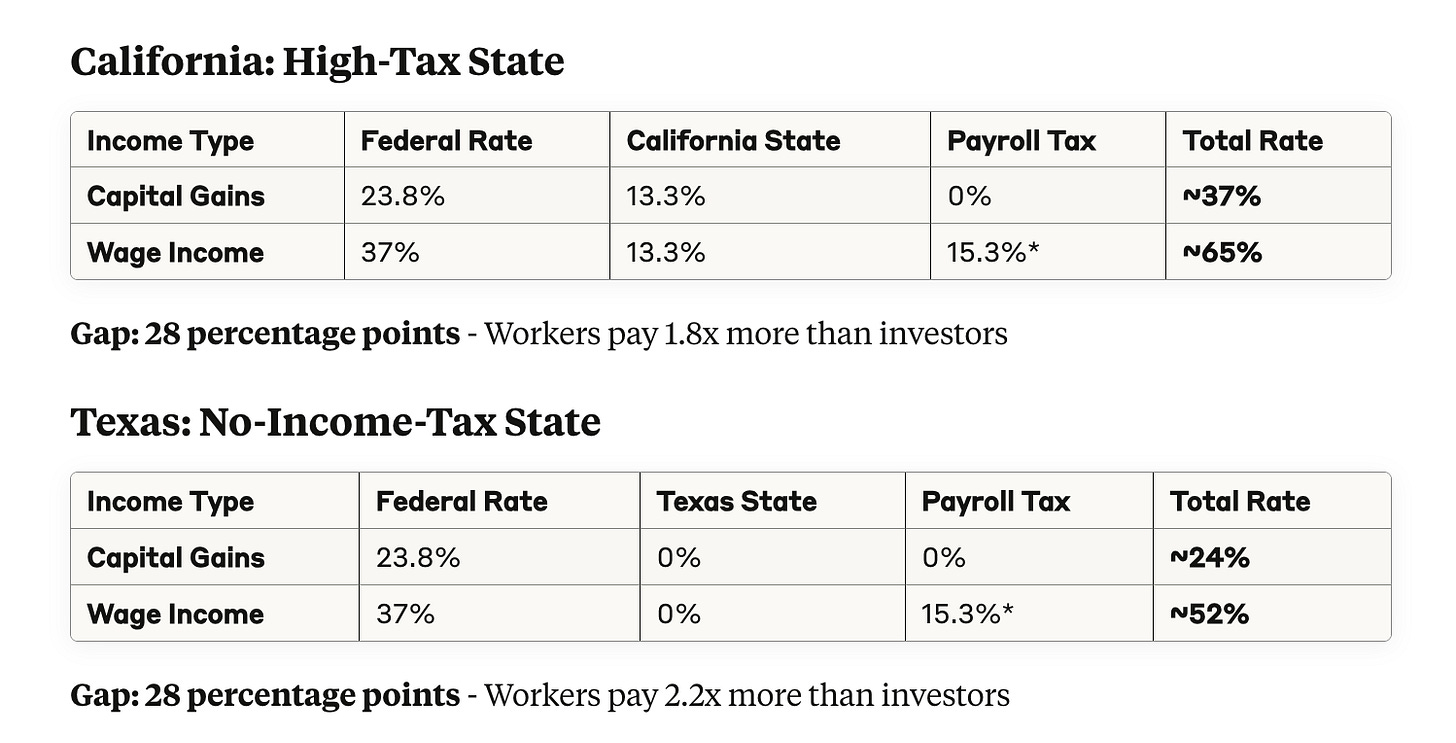

Consider the tax code's revealing asymmetry:

Super earners—surgeons, software engineers, and successful entrepreneurs—face the highest tax rates on their labor. These people create value, innovate, and build. They shoulder the heaviest burden.

Super owners, those living off inherited wealth, trust funds, and accumulated assets, often pay far less. They contribute only indirectly to productivity (by allocating capital) but have engineered the rules to preserve their position. Guess which one writes the tax code?

But here's the insidious part: The same super owners who minimize their tax contributions then lend their money to governments at interest. They extract value through tax avoidance, then profit again by financing the resulting deficits. It's double extraction, hidden behind the "sound fiscal management veil."

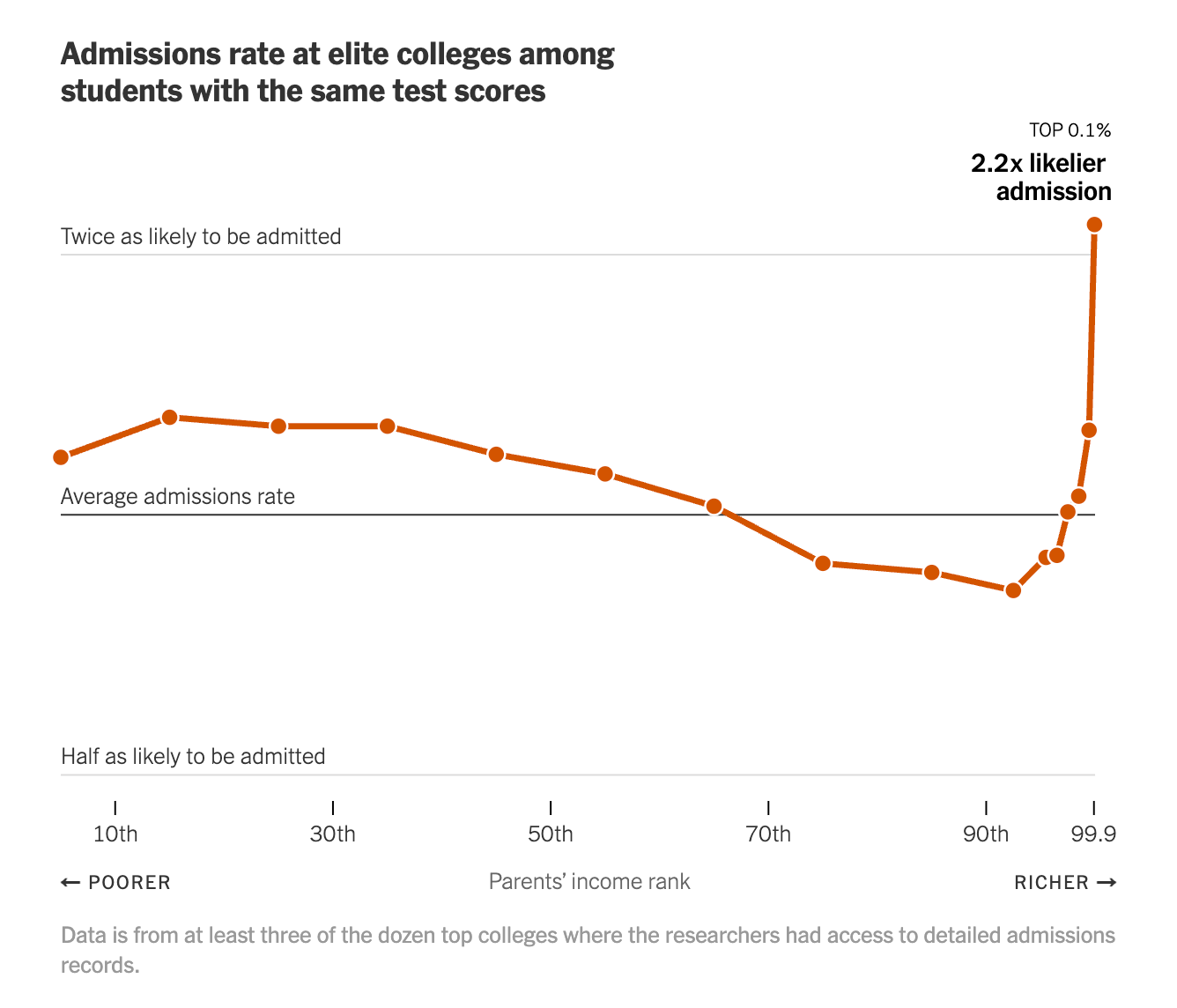

The problem is not only immediate, it is also generational. The top 0.1% “hiding in plain sight” among the merely wealthy have engineered a system that actively suppresses the prospects of the next generation of super-earners in favor of their Nepo-Babies. Nothing could show this more clearly than this chart showing the relationship between socio-economic group and university admissions to selective / Ivy colleges.

The group that is most discriminated against after controlling for grades is students around the 91st percentile. This is to make room for the true Nepo-Babies while maintaining a veneer of DEI.

This isn't mere unfairness. It's a civilizational death spiral. As mimetic competition intensifies among the ownership class, they don't just accumulate wealth; they accumulate claims on future production. Every treasury bond, every mortgage-backed security, every piece of paper wealth represents claims on future societal output of goods and services.

The debt isn't just financing government spending. It's funding an entire social order in which super owners can maintain ever-escalating consumption without appearing to extract directly from super earners or the masses.

The bill gets passed to the future, until the future arrives.

Here's the precise mechanism: as elite numbers expand, competition for status intensifies, driving up material consumption and political extraction. When this extraction exceeds what the productive economy can sustainably support, the gap gets financed through debt. The debt allows extraction to continue without immediate social breakdown, but only by deferring the reckoning.

This creates what Turchin calls "counter-elites," but the psychology of how counter-elites are made is more complex than simple exclusion. Counter-elites emerge from overlapping motivations, which is why, as Turchin recently pointed out, Revolutions tend to eat their own children.

The four principal motivations of the counter-elites and “disloyal elites”

Rebellion is rarely unified. The ranks of the counter-elite form around different grievances and motivations—some sincere, some opportunistic.

Structural Exclusion from Traditional Pathways

Examples: Steve Bannon, Peter Navarro, Kash Patel

These figures weren’t just locked out of elite institutions—they built influence by defying them. Their legitimacy comes from antagonism. They often turned rejection into power, using populist or nationalist frames to challenge systems they were never allowed to join.

Moral Revulsion at Visible Extraction

Examples: Mark Benioff, Chamath Palihapitiya (at times)

These are insiders who flinch. Often wealthy or institutionally integrated, they develop a visible discomfort with the structures that enriched them. Their critique is emotional and ethical: a desire to be on the right side of history, or at least to appear that way.

Pragmatic Concern About Systemic Sustainability

Examples: Ray Dalio, Warren Buffett

These are not revolutionaries. They are systems thinkers, worried that the flywheel is overheating. Their dissent isn’t about injustice per se—it’s about fragility. Their goal is survival: of markets, institutions, or reputations. They want a controlled reset, not collapse.

Competitive Positioning Within Elite Factions

Examples: Vivek Ramaswamy, Elon Musk, Trump, Most of Trump-World

This is dissent as a strategic maneuver—building new coalitions by discrediting old ones. These actors often attack “the elite” not to abolish it, but to reorder its hierarchy. Their endgame is still dominance, just under new rules and banners.

The result? Unstable counter-elite coalitions are often united more by what they oppose than what they propose.

(We'll explore this divide between creators and extractors more deeply in Part II, including how professional-class strivers often mistake themselves for elites while serving as the tax base for a genuine oligarchy.)

The Versailles Effect reveals how mimetic rivalry among elites drives exponentially growing extraction hidden behind debt. Super owners minimize their contributions while maximizing their claims, creating a double extraction that transfers wealth from producers to rentiers across generations.

When Institutions Stop Learning

Elite overproduction doesn't just create competition; it fundamentally breaks institutional learning. When every position becomes a prize in zero-sum competition, the attention of individual actors turns inwards. As a natural consequence of focusing on internal positioning over external goals, they develop "feedback hostility": an active resistance to information that challenges their structure.

They stop processing reality and become pure perception-management machines. Tech billionaires clash over AI regulation while ignoring its displacement effects. Financial titans split over monetary policy while the system grows more fragile. Media moguls propagate conflicting realities while trust in information itself collapses.

This creates a system where leaders prioritize internal power preservation over institutional health. No faction benefits from acknowledging fundamental crises, so they compete over narrative control. As Jon Schwarz states:

“The people who control institutions care first and foremost about their power within the institution rather than the power of the institution itself. Thus, they would rather the institution "fail" while they remain in power within the institution than for the institution to "succeed" if that requires them to lose power within the institution.”

Examples proliferate:

Universities expand administrative bloat while educational outcomes stagnate

Corporations prioritize financial engineering over actual engineering

Media outlets optimize for engagement over accuracy

Government agencies manage metrics instead of solving problems

Dr. Jill Biden props up her elderly husband to maintain family influence in the party

This creates a "simulation economy": institutions performing elaborate rituals that increasingly diverge from their stated purposes. They compete not on results, but on narrative control.

Rob Henderson calls the symbolic outputs "luxury beliefs": ideas that signal elite status while externalizing costs onto others. Think of the administrator advocating open borders from their gated community, or the tenured professor promoting credentialism while adjuncts live in poverty.

These aren't just hypocrisies. They're symptoms of institutions that have lost the ability to process reality.

When institutions develop feedback hostility, they stop learning and start performing. The result is a simulation economy where managing perception matters more than solving problems, until reality forcibly reasserts itself.

Reality Always Asserts Itself Eventually: The Triple Convergence

We face three interlocking crises:

Fiscal (Dalio): Debt approaching mathematical limits, with no politically viable resolution on the horizon.

Political (Turchin): Elite overproduction creates institutional paralysis and extraction.

Epistemic (Girard and Others): Institutions losing capacity to process feedback and adapt to reality.

Each crisis reinforces the others. Debt enables elite extraction. Elite competition prevents fiscal reform. Institutional decay blocks accurate diagnosis. Round and round we go, a civilizational spiral where each failure makes the next inevitable.

Traditional reform won't work because the reformers are products of the broken system. Every "solution" proposed by current elites somehow involves preserving their position while shifting costs elsewhere.

But here's what they miss: Reality doesn't care about narrative control.

What Breaks First?

Financial markets will reprice U.S. debt when faith in repayment-in-real-terms finally cracks. This isn't about default risk but the growing certainty of repayment in debased currency.

Elite institutions will face cascading legitimacy crises as their simulation games produce increasingly absurd outcomes. We're already seeing early signs: university applications dropping, trust in media collapsing, corporate DEI programs quietly disappearing.

Political systems will convulse as populist movements (of both left and right) challenge elite extraction. The elites will respond with increasingly desperate attempts at narrative control, further eroding their legitimacy.

Geopolitical systems will stall into strategic paralysis, as the U.S., China, the EU, and Russia each wait for one of the others to crack first. No one wants to make the first move—because every major power knows it’s standing on brittle foundations. What we’re witnessing isn’t confident statecraft; it’s synchronized hesitation. Tariffs, military posturing, and financial decoupling are all escalating—not because any bloc has a clear path forward, but because each hopes to absorb less damage than the others when the system buckles.

The breakdown is already beginning. But breakdown creates opportunity. As legacy institutions fail, space opens for new structures aligned with reality rather than perception.

The convergence in summary:

Unsustainable debt has become the mechanism for intergenerational wealth extraction

Elite mimetic rivalry drives ever-escalating consumption, hidden behind financial abstraction

Institutions have evolved to manage perception rather than solve problems

All three crises reinforce each other, blocking conventional reform

The system will break at its weakest points: currency faith, institutional legitimacy, and political stability

Parts II and III.

Elite conflict isn't just political; it's cultural, mimetic, and performative. In Part II, we explore how the "simulation economy" works, why luxury beliefs proliferate, and what happens when institutions detach entirely from the reality they claim to serve.

Part III will examine the wild cards that make this time different. While Dalio and Turchin rightly point to repeating cycles in human history, we have never been at this exact point before. Technological accelerationism, the worldwide internet, mass social media, smartphones, computers, modern weapons, drones, AI, and all their various second-order effects: none of these have ever combined with the long cycles in the forms that we are seeing today.

The old world is ending. The real question now is what we'll build next.

Subscribe to receive Parts II and III, where we explore the mechanics of institutional simulation and the emerging structures that will replace our failing systems.

Erratum: Peter Turchin’s Structural-Demographic model includes the fiscal health of the state as one of its key indicators, so I was not strictly correct to say that Dalio’s “long term debt cycle” model is distinct or a “different lens” from Turchin’s. Turchin views Dalio’s focus as one of the components of his SD model.

The idea of mimesis and how its failure leads to civilisational collapse was presented by Arnold Toynbee in "A study of history". It is also, though with an entirely different focus, key to gene-culture co-evolution for which the writings of Robert Boyd are key (also Joe Henrich). Fascinating stuff but difficult. Turchin's theory was in fact created by jack Goldstone in 1992 though restricted to the failure of early modern societies. I look forward to your next pieces.